Who’s Making Grants to Help Opportunity Zones Realize Their Promise?

/R. Wellen Photography/shutterstock

When the sweeping Tax Cuts and Jobs Act was signed into law in 2017, the ways it changed the tax treatment of real estate attracted broad attention. Escaping initial notice was a piece of legislation within it, the Investing in Opportunity Act, which incentivized private investment in some of the nation’s most distressed communities. Also hiding in plain sight was philanthropy’s potential role in its ultimate success.

The act grew from bipartisan work by leading economists, and attracted support from both sides of the aisle. It gave governors the opportunity to designate up to 25 percent of their state’s low-income, high poverty census tracts as Opportunity Zones (OZs). Those areas then became eligible for private investments through Opportunity Funds, pools of capital created to stimulate long-term community investments in exchange for significant tax incentives on capital gains.

The response has been swift, and the potential is enormous. In two short years, Opportunity Zones have been designated in all 50 states, D.C., and five U.S. territories. More than 8,700 zones have been certified by the U.S. Department of the Treasury. The Economic Innovation Group estimates that the pool of capital eligible for reinvestment could potentially reach $6.1 trillion—the largest in U.S. history.

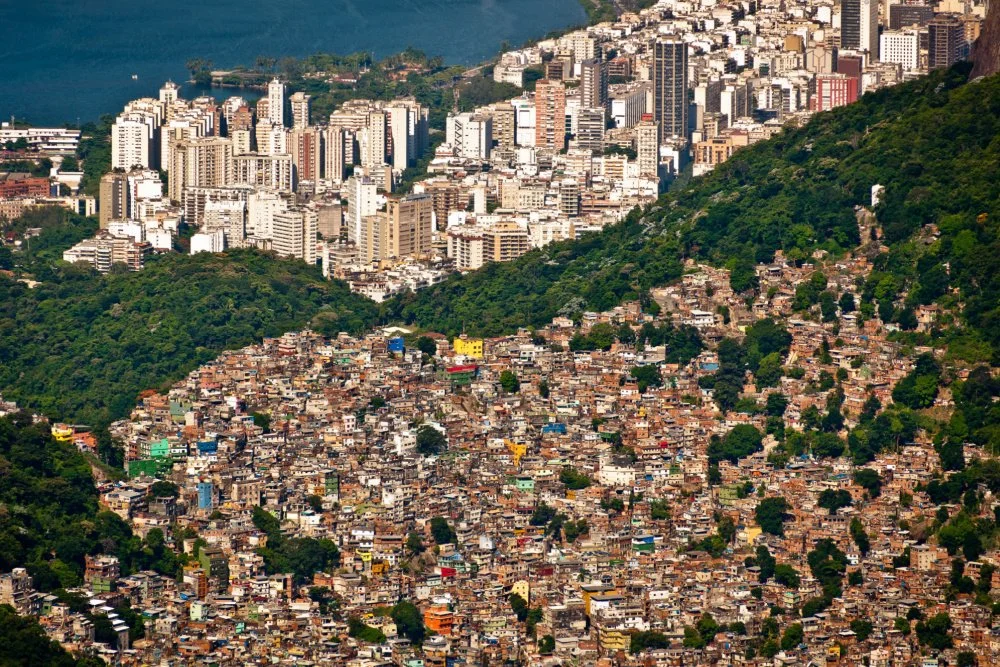

But critics have raised questions about the new law. Would the incentives really accelerate growth in areas of extreme poverty, or were those geographies already in line for development? Would investors find ways to game the system? And would the deep divide between the haves and the have-nots continue to grow?

What’s received less attention is what philanthropy might do to ensure that Opportunity Zones work as planned and actually benefit distressed communities.

Shamina Singh, president of the Mastercard Center for Inclusive Growth—an entity that works with both Mastercard and the Mastercard Foundation—thinks one way to help the zones achieve their promise is through “data philanthropy.” The center recently backed the idea with a $1 million partnership with Accelerator for America that’s designed to help city leaders prove the investment value of their geographies and make the best possible cases for achieving their long-term needs.

Singh sees a certain symmetry between her center and Accelerator for America. Both are rooted in the values of social impact, but came to life fairly recently, in the digital age, with the inherent nimbleness that brings to problem-solving.

The Mastercard Center for Inclusive Growth launched in 2014 with the mission of advancing sustainable and equitable economic growth and financial inclusion. The center says that its work represents a new approach to philanthropy that “attacks issues from all sides” by leveraging the company’s core assets and areas of expertise.

Accelerator for America (AFA) is newer still. The nonprofit consortium of mayors, community leaders and subject experts was founded by L.A. Mayor Eric Garcetti and AFA’s Rick Jacobs just two years ago, shortly after the Opportunity Act became law. Its mission is to scale and replicate local solutions to economic insecurity—to “drive national change from the ground up.” Accelerator works as a go-between to help communities and investors make intelligent, evidence-based decisions about the wide range of possibilities in Opportunity Zones. It describes itself the “R&D arm of cities and mayors.”

Both organizations consider data essential to spurring inclusive, long-term economic growth. Both are committed to boosting communities that lack the resources and know-how to attract public investment. But beyond that, Singh feels the partnership will build a sustainable infrastructure, de-risk programming and get the right voices to the table.

The center’s total $1 million commitment includes an $850,000 grant from the Mastercard Impact Fund that will provide community leaders in 50 cities with data-driven insights on current economic activity in their zones, and consulting on structuring and mobilizing inclusive investments. Leaders will also gain access to the Investment Prospectus tool AFA developed to help local communities partner with the private sector. In the longer term, the grant funds analyses of unmet needs for investment potential and ways to measure progress over time.

Using the center’s unique problem-solving model, the grant will be leveraged with in-kind support in the form of Mastercard’s economic development tools, research and data science expertise—things like data-driven insights on patterns of spend, and timely snapshots of already existing activity and gaps.

Other groups and foundations are establishing ways to support what could be a game-changer for distressed communities. The Rockefeller Foundation recently announced a $5.5 million initiative to attract responsible private investments in six cities. Its support funds and embeds a Chief Opportunity Zone Officer and two community engagement specialists in each city to conduct local support for OZ projects and businesses. A movement toward addressing broader OZ questions is also underway—issues like developing a shared-impact framework and shaping the market for Opportunity Funds.

Big city or rust belt, red state or blue. No one wants to leave $6 trillion on the table. As tax incentives kick in, Mastercard is not alone in seeing a real opportunity for philanthropy to ensure the new law works as intended: to benefit low-income communities. To level the playing field.