We Took a Deep Dive Into Mega-Donor Foundation Giving. Here’s What the Numbers Tell Us

/Gates is the emblematic living mega-donor foundation, but it’s also an outlier in many ways. Photo: FocusFantastic/shutterstock

Editor’s Note: This article was originally published on May 16, 2023.

Over the past 20 years, the philanthropic status quo has been dramatically upended by private foundations led by living mega-donors. Hailing from fields like tech, media and finance, the usual suspects — Bill Gates, Michael Bloomberg, the Buffetts and plenty more — have moved enormous amounts of money out the door seemingly unconstrained by institutional friction, all while making the kinds of big bets that more tight-laced “legacy” foundations could only dream of.

While these observations aren’t particularly new, we’re now able to back them up with some degree of quantitative rigor.

We took a deep dive into the most recently available Candid data on 85 private foundations overseen by living donors, looking at how much each entity disburses, how much it spends on overhead and top grantmaking priority areas. We also collected identical data for legacy funders like the Hewlett, Mellon and Kresge foundations. Our analysis excludes funders like MacKenzie Scott and the Ballmers who do not have foundations, nor does it capture extensive giving made through donor-advised funds (DAFs).

Note that while this data is several years old (from circa 2017–2019) due to the fact that organizations have three years beginning from the due date of the return to make Form 990s available, the data nonetheless provides an illuminating look into how living donors approach their giving through the private foundation model.

Let’s get a lay of the land by looking at the top 10 foundations of living mega-donors before digging into some more granular findings.

Top living donor foundations by total funding disbursed (2017-2019)

Bill & Melinda Gates Foundation: $13.7 billion

Bloomberg Family Foundation: $2 billion (figure excludes grants disbursed in 2018)

Susan Thompson Buffett Foundation: $1.9 billion

Walton Family Foundation: $1.5 billion

Gordon and Betty Moore Foundation: $900 million (Note: Gordon Moore passed away earlier this year)

JPB Foundation (Barbara Picower): $697 million

Wellspring Philanthropic Fund (C. Frederick Taylor): $674 million

NoVo Foundation (Peter and Jennifer Buffett): $656 million

Howard G. Buffett Foundation: $520 million

Sherwood Foundation (Susie Buffett): $568 million

Other donors whose foundations are in the dataset include those established by Sergey Brin, Charles and Liz Koch, Lynn Schusterman, Paul Singer, Eric and Wendy Schmidt, Michael and Susan Dell, Stanley and Fiona Druckenmiller, Jeff Skoll, Oprah Winfrey and Mike and Jackie Bezos. Also in the dataset are foundations started by Pam and Pierre Omidyar and Priscilla Chan and Mark Zuckerberg, who combine traditional 501(c)(3) grantmaking with the political giving and impact investing capacities of an LLC.

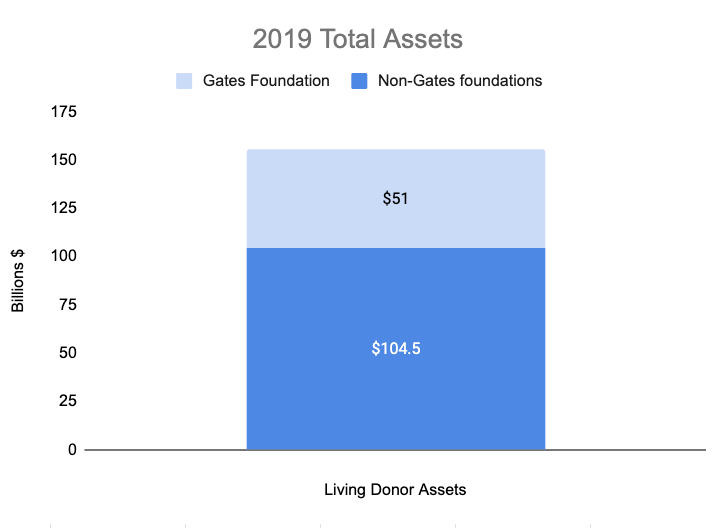

Total assets

In 2019, these 85 living donor foundations had a combined $155.5 billion in total assets, or $104.5 billion with the Gates Foundation removed from the dataset.

The median assets held by these foundations stood at $586 million, which may seem like a small number given the fact most of these donors are billionaires many times over. It’s also small compared to the assets of top legacy foundations like the Lilly Endowment and the Hewlett Foundation, which had $17 billion and $11 billion in total assets, respectively, in 2019.

Yet this $586 million figure underscores a key characteristic of living donors’ foundations — how donors use them as flexible pass-through entities while adhering to a “pay-as-you-go” model.

As one example, our dataset included giving from the Druckenmiller Foundation, the charitable vehicle of billionaire hedge fund manager Stanley Druckenmiller and his wife Fiona. Earlier this year, my colleague Michael Kavate asked Stanley Druckenmiller about his long-term philanthropic plans, and his response reflected the operational philosophy of many of his fellow mega-donors. “It’s pretty much a pay-as-you-go system,” he said. “If I have a big year, we put a lot in. If I don’t make enough money to cover expenses, we don’t put a lot in that year. There’s no systematic plan. I hope we put a lot into the foundation, because it means I made a lot of money and been a success.”

This isn’t to suggest these mega-donors’ foundations are living paycheck to paycheck (figuratively). For the fiscal year ending 2019, the Druckenmiller Foundation had $1.3 billion in total assets. But on the whole, “pay-as-you-go” living foundations have fewer assets than legacy foundations with large endowments, many of which were established in the mid-20th century and have grown — or, at least, haven’t shrunk — since then.

Total charitable disbursements

The living donor foundations in our dataset disbursed $16.5 billion in 2019, and $10.7 billion when we omit the Gates Foundation. The median disbursement amount was $66 million.

Charitable disbursements as percentage of average investable assets

Living donor foundations’ charitable disbursements constituted 11.3% of their average investable assets, or 10.9% when the Gates Foundation is removed from the dataset.

These previous two graphs suggest that living donor foundations are moving lots of money out the door, but it’s important to note that disbursements may not have necessarily flowed to working nonprofits. Billionaire givers have a penchant for channeling significant amounts of money to their DAFs, from which they are under no obligation to move any money out the door. For example, in 2018, Mark Zuckerberg and Priscilla Chan donated $214 million worth of Facebook stock from their Chan Zuckerberg Initiative to a DAF at the Silicon Valley Community Foundation.

Of course, mega-donors do make huge gifts that end up in nonprofits’ checking accounts. Wielding enormous personal fortunes and encountering relatively little administrative resistance, they can make whatever decisions they want and as quickly as they want. This freedom has obvious downsides, making missteps more likely, but it also means living donors can do things that legacy foundation leaders cannot — such as making bigger, riskier investments on a faster timeline. We saw this dynamic play out in the early days of the pandemic. While critics argued that billionaires could have given more as the pandemic proceeded, donors like the Gateses, George Soros, Jeff Bezos and Michael Dell quickly made commitments in the $100 million range.

Incoming contributions

Incoming contributions to living donor foundations — including cash, stock and other assets — totaled $11.8 billion in 2019, or $5.9 billion when the Gates Foundation is excluded from the data set. The median amount of incoming contributions in 2019 was $57 million.

This figure is a testament to donors’ penchant for using foundations as pass-through entities. As Druckenmiller noted, if he or another donor has a “big year,” then more money flows into the foundation. Donors are also incentivized to make contributions even if they have a not-so-big year, since the donor receives an income tax deduction for any amount contributed to a private foundation (subject to some IRS limits). Donors also get an income tax deduction for contributing appreciated stock.

Grants and charitable expenses as a percentage of total disbursements

Living donor foundations move a lot of money out the door with low overhead, earmarking 88% of expenses toward charitable expenses versus 12% for administrative expenses. These figures were 91.4% and 8.6%, respectively, when the Gates Foundation — with 1,700 employees around the world and counting — was removed from the dataset.

We also created a control group consisting of 150 “typical” legacy foundations — as far as a typical foundation can be said to exist. (For example, the control group did not include corporate foundations or “atypical” foundations where most of the funder’s assets are tied up in art holdings.) As we see below, foundations in the control group showed more signs of administrative bloat compared to non-Gates living donor foundations, allocating 86.4% of expenses toward charitable disbursements and 13.6% for administrative expenses.

There are a couple of ways to parse the comparatively lean operations of living donor foundations. Coming from business, many of these donors could be reflexively tight fisted when it comes to spending for overhead. Some may be wary of institutions developing their own agenda or staffing choices that lock in certain strategies. Others are still young and may not have the bandwidth to create sizable staffed foundations and often want to remain nimble as they figure out their priorities.

Refraining from building out a sprawling bureaucracy speaks to one of the key operational consequences of the “pay-as-you-go” philosophy. Why put in place mountains of red tape to anticipate the needs of future generations if you plan to give away most of your assets during your lifetime or spend down your foundation entirely?

Of course, living donor foundations still have to plug internal knowledge gaps, but thanks to the rise of more robust philanthropic intermediaries, nearly everything can be outsourced. A closer look at these foundations’ managed operating and administrative expenses revealed that 47.5% of legal, accounting, “other professional services” and “other” services were handled externally, compared to 38.1% for the control group.

It’s also worth noting that some donors, like the Gateses, preside over foundations replete with large staffs and highly professionalized grantmaking operations. Others, like the Arnolds and Dustin Moskovitz and Cari Tuna, have built relatively staff-heavy hybrid giving operations that include or previously included a foundation component, and thus made this list. But on the whole, the data suggests living donors run relatively streamlined operations.

Top “legacy” funders by total funding disbursed (2017–2019)

While “legacy” funders weren’t the primary focus of our analysis, here are the top ten legacies by total funding disbursements from 2017–2019, as a reference.

Ford Foundation: $1.8 billion

Lilly Endowment: $1.6 billion

William and Flora Hewlett Foundation: $1.3 billion

Robert Wood Johnson Foundation: $1.2 billion

John D. and Catherine T. MacArthur Foundation: $985 million

David and Lucile Packard Foundation: $961 million

Mellon Foundation: $912 million

Leona M. and Harry B. Helmsley Charitable Trust: $727 million

Kresge Foundation: $672 million

Duke Endowment: $539 million

Living vs. legacy foundation priorities

Finally, here’s a look at how legacy foundation priorities differ from those of foundations overseen by living donors.

Here, we see that legacy foundations allocated 17.9% of support for education versus 18.2% for living donors. There’s less consensus when it comes to health. At 20.9%, health was the top issue for living donors, but it came in third at 10.3% for legacy donors. We can attribute this discrepancy to the outsized influence of the Gates Foundation, for which global health is a top priority. We see another divergence around the “international relations” priority area. At 11.9%, it’s the third-largest priority area for living donors, but for legacy funders, it clocks in at No. 11, at 3.2%. Here, it appears that George Soros’ global giving contributes to this gap.

There’s also a notable variance when it comes to “community and economy.” Legacy funders disbursed 11.1% of support toward this area versus 7.6% for living donors. One way to explain this discrepancy is that since many affluent living donors hail from global industries like finance and tech, they’re more inclined to have an internationally focused philanthropic outlook, much to the consternation of critics who argue that these givers should be doing more to support local organizations.

The big caveat here is that both types of funders likely ramped up support for public health and racial justice after the transformative events of 2020. Subsequent analysis of Candid data will determine if, and to what degree, that trend played out.

Correction: This article reflects updated information about Wellspring Philanthropic Fund.