7 Tips for Using Tax-Exempt “Charitable” Gifts to Get Your Candidates Elected

/

Editor’s Note: This article was first published in August 2016.

If you have some extra cash, and you want to give your political candidates a boost this fall—while also getting a nice tax break—you’ve come to the right place.

We know what you’re thinking: Campaign gifts aren’t tax deductible. That’s true, technically. But the beauty of America’s hallowed institution of philanthropy is that the rules around giving are so loose that any smart donor—people just like you—can make gifts to achieve partisan goals and get the same tax deduction as if, say, they were helping out blind kids.

How exactly does this work in practice? I’m glad you asked. Here are seven tips for deploying your tax-exempt charitable dollars to get your candidates elected. But with November right around the corner, you’ll need to hurry!

(1) Give to Mobilize Your Side’s Voters

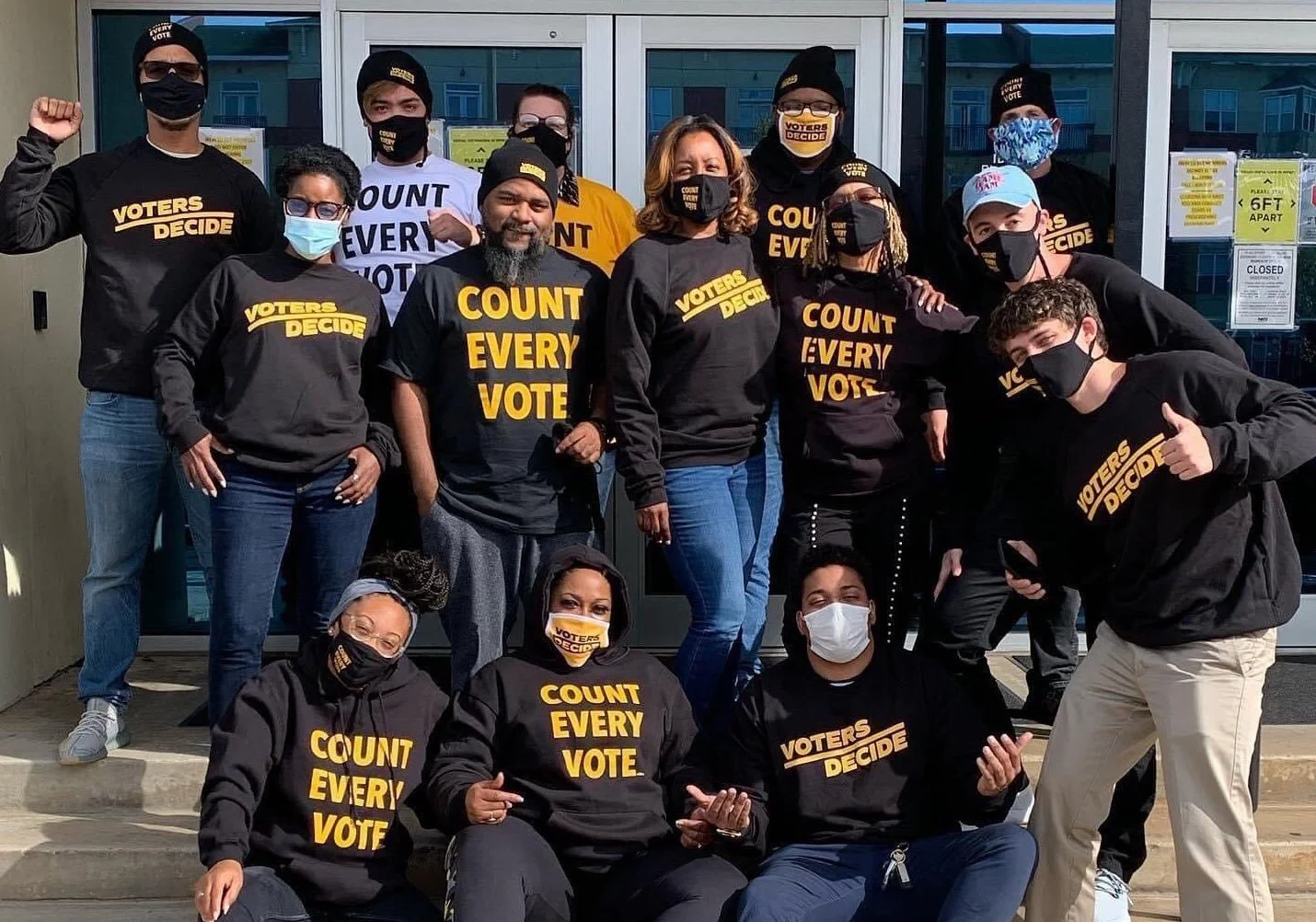

Everyone knows that elections are decided by turnout, and your gifts can ensure that the right voters come out in droves for the candidates you like. It’s as simple as giving money to nonprofit groups that register voters known to back candidates on your side, or that push for laws making it easier for such folks to vote. Yup, that’s all perfectly legal work for 501(c)(3) organizations. If you’re rooting for Democrats, you’ll want to send your checks to groups that register low-income, nonwhite voters or seek full implementation of the National Voter Registration Act, which allows people to register when they get public assistance. Make sure only to back such work in swing states. No need to waste your generous gifts to improve civic life in places like California. If you’re a Republican, I’d recommend faith-based nonprofits seeking to register and educate evangelical voters. You’ll be amazed by how those doing God’s work can sway elections by a few crucial percentage points.

(2) Finance Efforts to Suppress the Other Side’s Voters

Turning out more of your side’s voters is great, but even better is keeping the other team’s voters away from the polls. If you’re a Republican, I have some good news: Lots of 501(c)(3) organizations are working to do exactly that by pushing voter ID laws in the states or defending existing ones. What’s so great about voter ID laws? That’s easy: African-Americans and Latinos are far less likely to have ID! And we know how those folks tend to vote. So go crazy on this one, and don’t worry about the IRS. Who are they to argue with nonprofit efforts to preserve the “integrity” of the U.S. electoral system? Also, if you’re a wee bit embarrassed by this kind of giving—since people, um, died for the right to vote—just use an anonymous donor-advised fund like DonorsTrust. Your secret will be safe forever. Again, though, remember to stick with giving in swing states. One other thing: If you’re worried about recent court challenges to voter ID laws, I have plenty of legal policy groups I can highly recommend, like Judicial Watch, which is doing heroic work to keep people of color out of voting booths. Who said Jim Crow was dead?

(3) Smear Politicians You Dislike

Okay, enough with that all boring voting stuff. Let’s get down to brass tacks—namely, finding ways your tax-exempt charitable gifts can be used to attack and discredit politicians you really don’t like. I know, I know: Such work sounds like it’s gotta cross the legal line, and you’re probably a little nervous about this kind of talk, as much you love the sharp elbow stuff. Actually, though, using philanthropy for character assassination is a piece of cake and will even pass muster with the lawyers at your family office. Richard Mellon Scaife could write a book on this subject (I mean, if he were still alive.) Scaife was the genius billionaire heir who was at the center of the quite real “vast right-wing conspiracy” that went after the Clintons in the 1990s, culminating in the impeachment of Bill.

What’d Scaife do, exactly? For starters, he used his foundation to bankroll a nonprofit conservative magazine, the American Spectator and its “Arkansas Project,” which worked to dig up dirt on Bill. The Spectator scored big with the “Troopergate” story, which led to the Paula Jones lawsuit that, in turn, eventually arrived at Monica Lewinsky’s doorstep. That suit was supported over years by lawyers with ties to a nonprofit legal group that Scaife had also long supported, the Federalist Society. And many of the costs were borne by another nonprofit, the Rutherford Institute. These modest philanthropic investments paid off big time, since Clinton’s impeachment arguably explains Al Gore’s narrow loss to George W. Bush at a moment of record prosperity. Ask any Iraqi how the rest of the story goes.

Now, you’re probably wondering what all this ancient history has to do with your charitable gifts. It’s really pretty simple: All these same tactics still work today. If you’re not a fan of Hillary Clinton, for example, I’d recommend cutting a check—and fast!—to the Government Accountability Institute, which is a nonprofit that describes itself as investigating crony capitalism and government malfeasance, but mainly seems to be a platform for Peter Schweizer, who’s lately made a career of attacking the Clintons and the Clinton Foundation, through his book Clinton Cash and myriad media appearances. Wait, you’re thinking, can your charitable gifts really bankroll a one-man partisan wrecking crew like Scheizwer? You bet they can. Just ask hedge funder Robert Mercer, who got to write off a $1 million gift to GAI in 2013.

(4) Defend Politicians You Like

Getting down in the gutter isn’t for every philanthropist, I realize, and so you may be wondering how your gifts can be used to stand up for the worthy politicians you care about. Well, you’re in luck, since there are plenty of options on this front, too. Consider David Brock’s nonprofit operations. While Brock was the author of that “Troopergate” article I mentioned above, he’s since turned into Hillary Clinton’s most aggressive defender. Brock is the guy who started Correct the Record, which works night and day to swat down Clinton’s critics. You can’t get a deduction for donating to that group, which is a Super PAC, but you can give a generous charitable gift to Brock’s other operation, Media Matters for America, a 501(c)(3) that also does a fair amount of swatting of Clinton attacks in service of its mission of “comprehensively monitoring, analyzing, and correcting conservative misinformation in the U.S. media.” For example, it has run dozens of blog posts rebutting media claims about corruption at the Clinton Foundation. Media Matters is also pretty good at whacking Donald Trump for his many inanities, so this one is a twofer.

(5) Arm Your Candidates With Strong Ideas

At the end of the day, if you want your candidates to win elections, they better have some good ideas and smart advisors. Fortunately, this is the easiest kind of help you can provide with your charitable gifts. Just pump money into one of the many think tanks that work hand-in-glove with partisan public officials. If you’re on the right, I’d recommend the American Enterprise Institute, which offers a home to lots of former Bush administration officials who are deeply plugged in to GOP politics. Of course, the Heritage Foundation is another choice if you're a Tea Party type. As for Democrats, the Center for American Progress is the obvious place to send your tax-deductible gift, seeing as how its founder, John Podesta, now chairs Hillary’s campaign and its current CEO, Neera Tanden, is a former Clinton aide who may well serve in her administration. CAP has provided all sorts of policy ideas that have been reflected in Hillary’s positions. Lots of bang for the buck, here.

(6) Make Sure That People Like You Can Give Unlimited Donations to Politicians

All this roundabout philanthropy to influence elections may sound like a lot of trouble to some wealthy readers, who’d rather stick to direct political giving. So let’s talk about how your charitable gifts can allow you to play that game on a big, bold level. As you may know, Citizens United—which is boon to political junkie donors like you—is likely to come under fierce attack in coming years, as the Supreme Court tilts left. If you want this landmark decision defending free speech to survive, I’d recommend giving money to the conservative judicial groups that will be fighting tool and nail to preserve Citizens United. If you have to redirect some of your gifts away from Andover and Harvard, it will be worth it. Remember, we're talking about individual liberty, here.

(7) Stop Rich People From Giving so Much Money to Politicians

It sounds crazy, I know, but not all wealthy people want to be able to pay legal bribes to politicians. Some actually believe we should get money out of elections so that the will of the people triumphs over special interests and, presumably, ushers in a new era of progressive policymaking. If you’re one of these rich liberals (a.k.a., class traitors), there are plenty of nonprofits working to get money out of politics at both the federal and state level, so take your pick. Bizarrely enough, some of America's top campaign donors—like George Soros—also support such outfits. If I had more time, I'd square that circle for you.

One last thought: If money is ever actually barred from politics in any significant way, philanthropy will become an even bigger tool for influencing electoral outcomes and public policy. But here’s some good news for the wealthy donor class: Pretty much the entire nonprofit and foundation establishment is dead set against tighter restrictions on the use of private wealth to influence public policy. So no matter what happens, rich people like you will always find a way to speak more loudly than your fellow citizens. I bet Alexis Tocqueville—that great early cheerleader for American civil society—is smiling from his grave. Right?