What a Big Bank is Doing to Boost Economic Opportunity in a Single City

/As the GOP finalized its Tax Cuts and Jobs Act late last year, it was already clear that the legislation would mean additional profits for major corporations, on top of their already impressive earnings in an economy that’s working—for them, at least. The nation’s largest banks are no exception. At JPMorgan Chase, for instance, start-of-year estimates pegged the company’s tax windfall at $4 billion a year, a boost that prompted the bank to up its philanthropic commitments by 40 percent. Citi is also making moves, forging ahead with its Community Progress Makers grants and youth workforce funding.

Given that landscape, it isn’t surprising to see another one of the “Big Four” American banks increase its philanthropic commitment with a splashy new program and a sizable giving pledge. This time, however, it’s Wells Fargo, which is still battling major scandals that have seriously tarnished its brand and cemented many Americans’ unease with big finance.

Wells Fargo’s direction here is interesting. Unlike several of its competitors, Citi among them, the bank has chosen to focus on a single city: Washington, D.C. Last month, it promised over $1.6 billion in loans and grants over the next five years, with a focus on community investment in the nation’s capital. That follows a pledge—coinciding with the passage of last year’s tax bill—to target $400 million in philanthropic donations in 2018 and to raise its minimum pay rate to $15 an hour.

The bank’s D.C. master plan, which it calls “Where We Live,” involves two components. The largest by far isn’t strictly philanthropic. Wells Fargo intends to invest over $1.5 billion into small business, community development, affordable housing and the like. The investment initiative prioritizes Wards 7 and 8, which contain a high proportion of lower-income black households. Then there are the grants, four of which have already gone out to complementary nonprofits like DC Central Kitchen, SOME, the Washington Area Community Investment Fund, and MANNA, Inc.

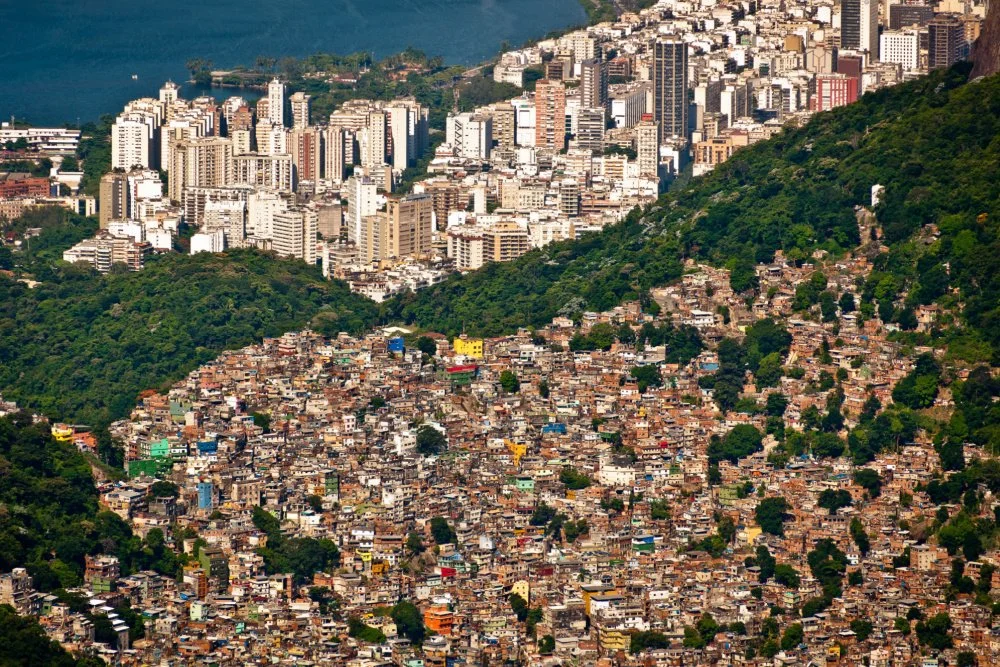

In a press release, Wells Fargo CEO Tim Sloan remarked that “the Where We Live program is rooted in two things: investments that help people live, work and thrive, and a deep understanding that neighborhoods need long-term partners.” That approach, and those sentiments, mirror how other big banks are rolling out their philanthropy. Across the board, there’s a major focus on boosting urban economies, particularly by empowering low-income people of color to start businesses and access capital that wouldn’t otherwise be available to them.

As we’ve seen with JPMorgan Chase, which has also made D.C. one of its focal points, this brand of bank giving isn’t wholly altruistic. Not only does workforce development funding grow banks’ potential hiring pools; figures like JPMorgan Chase CEO Jamie Dimon have argued that more prosperous cities with less inequality mean more profit for the banking sector.

For all the harm that the big banks inflicted on urban America through predatory lending during the housing boom, these institutions also have powerful assets for doing good, quite apart from their deep troves of financial capital. They’re able to tap reams of financial data on households and small businesses that can drive better-targeted community investment decisions. And they have sprawling physical infrastructure across urban America, including tens of thousands of employees with technical skills. Foundations, rich though they may be, simply don’t have branch offices on every street corner.

Related:

Banking Against Urban Poverty: Inside JPMorgan Chase Philanthropy

Hubs of Opportunity: A Big Bank Rolls Out More Urban Support

It’s hard not to see any philanthropy from Wells Fargo right now as a bid for atonement. The bank is still mired in the fallout from multiple scandals, including a remediation process to pay back customers wrongly charged for auto insurance. That came with a $1 billion penalty in April, and Wells Fargo expects to compensate customers to the tune of $212 million in a process that won’t wrap up until 2020.

Wells Fargo’s eagerness to recover from its self-imposed setbacks could underscore the direction and geography of its giving. Making a charitable splash in D.C. may increase the bank’s positive visibility in the Beltway, softening its image to lawmakers and regulators—at least indirectly. And while plenty of Wells Fargo’s competitors are rolling out community development support, its focus on that arena brings to mind another recent signifier of its failings: the Community Reinvestment Act, or CRA.

As a bit of background, CRA dates back to 1977. Its intent was to reverse decades of redlining and other discriminatory lending practices by encouraging private sector banks to invest in low-income areas, and sanctioning them if they failed. Last year, primarily due to the account fraud scandal and other malpractice, the federal Office of the Comptroller of the Currency downgraded Wells Fargo’s rating under the act, a move that meant even more regulatory hurdles for the company.

As it prepared to debut the “Where We Live” program in D.C., Wells Fargo worked closely with the National Community Reinvestment Coalition (NCRC), which advocates for increased investment in underserved neighborhoods. NCRC has been a strong supporter of the CRA, which the organization’s CEO Jesse Van Tol refers to as “a landmark civil rights law.”

As Van Tol discusses in an August New York Times op-ed, the Trump administration has floated changes to CRA that could weaken it. Many bankers are on board, citing cumbersome and outdated regulatory requirements tethered to the notion that banking occurs at physical branches—and not online or via apps. “We’re eager to work with the regulatory agencies, Congress, banks and the entire financial sector to modernize [CRA],” Van Tol writes. But simply stripping away geographic lending requirements could signal a return to redlining, he argues.

It’s interesting to see Wells Fargo collaborating with NCRC, given the fact that the company might benefit from the weakened regulatory framework Van Tol opposes. Given its CRA downgrade, the bank obviously has an interest in accumulating community development merits.

The expanding efforts by top banks to boost economic opportunity in urban America are an important and hopeful development. But like so much corporate philanthropy these days, the big banks’ community development giving deserves close scrutiny.

Related: Joined at the Hip: Community Development Finance and Big Banks