Pete Peterson: Hard Lessons From a Billionaire's Philanthropy

/The national debt clock in New York City. Photo: Leonard Zhukovsky/shutterstock

Whether you agreed with his views or not, the billionaire Peter G. Peterson, who died yesterday at the age of 91, stood as a leading example of a philanthropist who was highly focused, disciplined, and understood the leverage of investing in public policy work.

When he signed the Giving Pledge, Peterson recalled that he learned the values of giving from his father, a Greek immigrant who owned a diner in Nebraska, who "fed countless numbers of hungry poor who came knocking on the back door of his restaurant."

Peterson himself would come to practice the most rarefied form of elite philanthropy.

Forbes once described Peterson as having "one of the most distinguished resumes in America." He was a former Wall Street executive and U.S. Commerce Secretary who later became a private equity billionaire. Over decades, Peterson used both his huge Rolodex and personal wealth to advance his views. As a mega-donor, he made all the right moves: staying laser-focused on just a few causes, bankrolling an activist foundation with a limited agenda yet a big endowment, and putting both his time and money behind several top-tier nonprofits where he served as a major donor and board member.

Yet the results of Peterson's philanthropy were decidedly mixed. He didn't have nearly the impact he hoped in the face of strong political headwinds. And some of his giving had unintended or negative consequences. At a moment when many top donors are looking to parlay wealth into public policy influence, Peterson's giving stands as both a model to emulate—illuminating how to pull the levers of power—and a cautionary tale.

Three nonprofit institutions bear the late billionaire's name: the Peterson Institute for International Economics, a top Washington policy group he has chaired for years, and that was renamed after he gave it $50 million in 2006; the Peterson Center on Healthcare, which he founded with a $200 million gift to reshape U.S. healthcare; and the Peter G. Peterson Foundation, which is run by his son, Michael.

Peterson established his foundation in 2008 after he scored a windfall with the IPO of Blackstone, the private equity firm he’d helped build. Peterson pledged a billion dollars to the foundation, with the sole goal of curbing long-term budget deficits.

Peterson had been sounding the alarm on fiscal issues since the early 1990s, when he co-founded and helped fund the Concord Coalition. As a billionaire, though, he was able to pour far greater resources into this cause.

The Peterson Foundation got up and running as the U.S. economy coped with the aftermath of the 2008 fiscal crisis, which sent federal deficits into the stratosphere as tax receipts fell and the government engaged in stimulus spending to prop up economic demand. While such stimulus was broadly supported by economists, the specter of trillion-dollar budget gaps—temporary though they were—frightened many Americans, both in and outside Washington.

The Peterson Foundation spent millions to fan these fears, helping finance deficit watchdog groups, as well as projects at a range of think tanks, and public education efforts by the Peterson Foundation itself.

By 2010, the work backed by Peterson was all over Washington, sounding the alarm about the growing national debt—and lending mainstream credibility to conservative calls to slash government spending, which many top economists saw as misguided given the weak recovery and unemployment still over 9 percent. Meanwhile, poll after poll showed that most Americans wanted their elected leaders to focus on creating jobs, not cutting the deficit. Even Peterson himself, a centrist in his views, didn’t favor big, immediate budget cuts that could harm near-term growth. Rather, he saw the rising deficit fears as an opening to push the long-term entitlement reforms he had favored for many years, with those cuts phased in gradually.

But few members of the new Tea Party, which emerged as a powerful political force in 2009, were so subtle in their thinking. They wanted big budget cuts, immediately. Whether intentionally or not, the work of the Peterson Foundation helped to strengthen the hand of this populist right-wing movement.

In February of 2010, in response to a growing concerns about the deficit, President Obama created the National Commission on Fiscal Responsibility and Reform, co-chaired by two former public officials, Alan Simpson and Erskine Bowles. The Simpson-Bowles Commission issued its recommendations in December 2010, proposing to reduce deficits through some tax increases, but mainly through spending cuts, with a big focus on the long-term reforms to Social Security and Medicare that Pete Peterson supported. Eighteen months after the commission had finished its work, its co-chairs helped launch a high-profile advocacy effort called the Campaign to Fix the Debt, which included television ads, and was primarily financed by the Peter G. Peterson Foundation.

The Simpson-Bowles Commission, and the PR blitz that followed, cemented the deficit as a top issue in Washington in 2011 and 2012—even as unemployment remained stubbornly over 8 percent. As it turned out, though, deficit reduction didn’t go anything like Peterson or thoughtful fiscal hawks had hoped. Tea Party hardliners were calling the shots after the GOP takeover of Congress, even threatening to default on the national debt. Ultimately, deficits were cut through mandatory across-the-board spending cuts—while putting off the kind of entitlement reform that Peterson favored and sidestepping the tax hikes recommended by the commission. As the ax fell everywhere, including on vital areas like scientific research, Simpson and Bowles called the forced cuts “mindless.”

Peterson wasn’t pleased with the outcome, either, complaining that Washington was not yet “talking about the underlying problem that confronts the long-term future.” But he vowed to push on with his funding on deficits and debt. In the past year, though, things have only gotten worse. Congress passed a tax bill that will add an estimated $1.5 trillion to the national debt.

Aside from the unintended consequences of his giving on fiscal policy, Peterson's efforts in this area underscore the limits of philanthropy in tackling big national issues. When Pete Peterson started the Concord Coalition in 1992, the U.S. national debt was $6.5 trillion. When he started his foundation in 2008, it was $14.7 trillion. Now, it's $20 trillion and set to rise even higher. To the extent that entitlement reform is on the agenda, it's used by ideologues who dream of radically downsizing government. Among Pete Peterson's miscalculations was a failure to appreciate the deep cynicism and bad faith of a modern Republican Party that hasn't actually cared about the deficit since the days of George H.W. Bush. Too often, Peterson's giving provided ammunition to these opportunists.

Peterson's other biggest cause, his commitment to an open global system and free trade, also yielded mixed results. The Peterson Institute for International Economics has long been one of the leading voices in Washington for an approach to globalization that trumpeted the gains from free trade but gave little attention to the economic losers left in its wake. In retrospect, it was only a matter of time before a presidential candidate came along and weaponized the trade issue to win over those voters who'd been left behind. Now, in the era of Trump and Brexit, with protectionism rising, the post-war international economic system stands in peril. The Peterson Institute, with day-to-day operations mainly funded by corporations, should have been working long ago to get ahead of this curve. The fact that it didn't underscores the blind spots of the kind of elite philanthropy practiced by Pete Peterson and other wealthy donors.

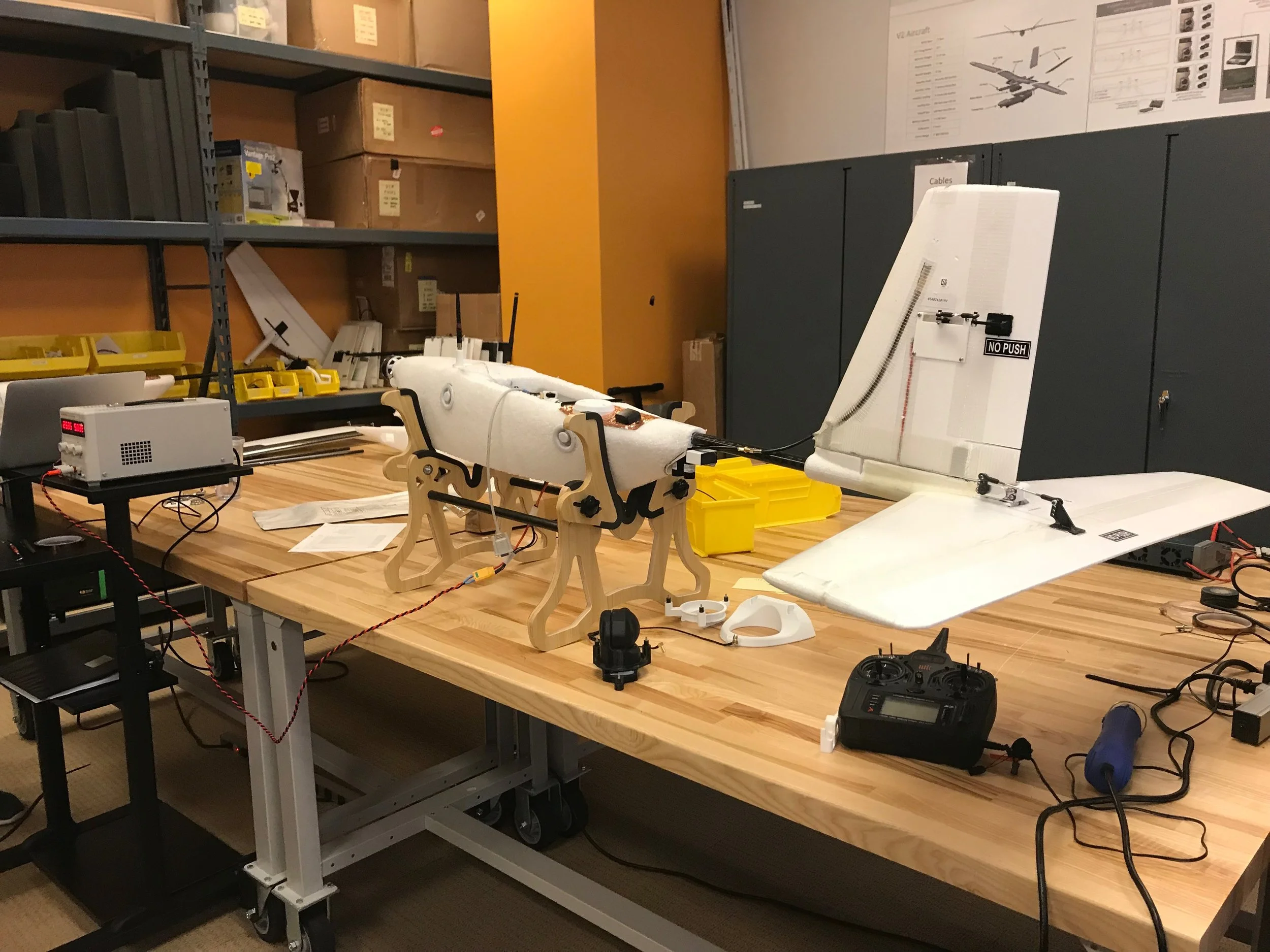

In recent years, Pete Peterson extended his philanthropy to the area of healthcare, bankrolling a new center with an initial $200 million gift that will look at how to improve the quality and efficiency of the U.S. healthcare system while lowering costs. The Peterson Foundation's efforts to contain healthcare costs dovetail with its broader fiscal agenda, since such costs are a main driver of long-term deficits. In that sense, this move was both smart and strategic.

But healthcare is another big, tough issue. It's the scene of deeply polarized ideological conflict and the stomping ground of some of the most powerful special interests in the nation. It remains to be seen what kind of success this latest Peterson effort will yield.

One last point: Before he passed away, Peterson's net worth was estimated at $2 billion and his foundation last reported assets of $652 million. Which means that in terms of Peterson's long-term philanthropic legacy, we may be still be quite early in the story. The greatest impact of his vision and wealth may be yet to come.

Stay tuned.