Private Foundations and the Law: The Trump Case as a Learning Moment

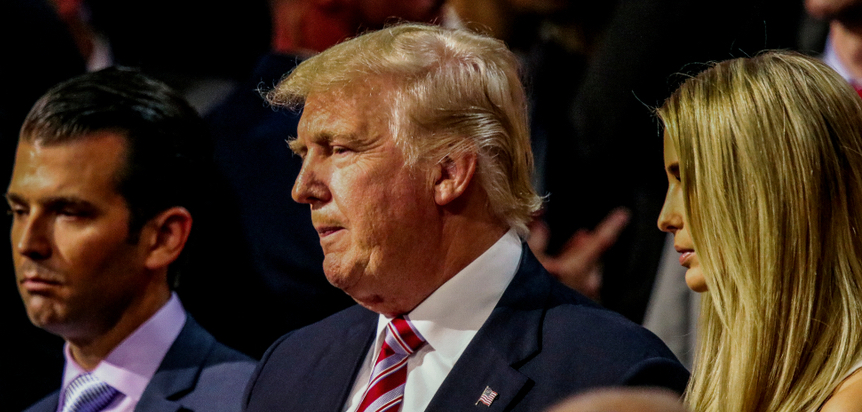

/photo: mark reinstein/shutterstock

Editor's Note: This article is the first in a series looking at the lawsuit against the Trump Foundation, brought by the New York State Attorney General. See all the posts here.

On June 14, 2018, Barbara D. Underwood, Attorney General of the State of New York filed suit in the name of the people of New York against the Donald J. Trump Foundation. Also named were Donald J. Trump, Ivanka Trump and Eric F. Trump as Foundation Board members.

This legal action is the result of an investigation by the New York AG that began in June 2016, 5 months in advance of the 2016 Presidential elections. The investigation was begun by then New York Attorney General Eric Schneiderman who resigned from office on May 8, 2018 amid allegations of serious sexual misconduct.

The investigation into the Trump Foundation was carried on by Underwood and was conducted pursuant to New York Not-for-Profit Corporation Law; New York Estates, Powers and Trusts Law; and the New York Executive Law.

To say this suit an unusual action by the New York AG is an understatement. I have written extensively in this column about the lack of charity oversight exercised by state AGs across America. In New York specifically, I questioned where the NY AG was when Lincoln Center was going about changing the name of Avery Fisher Hall and applauded the AG’s late but eventual entry into the goings on at Cooper Union, the college founded by Peter Cooper in 1859. Significant questions are circulating about the activities at City University of New York (CUNY) but the AG is not yet significantly involved in this controversy. This Trump Foundation action is, therefore, unique and noteworthy for all private foundations.

Regardless of whether you believe this legal action against the Trump Foundation is politically motivated and without merit, it does serve to drive home some important concepts relative to the operation of private foundations operating in New York State and elsewhere as well.

In broad terms, the charges against the Trump Foundation are that it engaged in improper and extensive political activity, repeated and willful self-dealing transactions, and a failure to follow basic fiduciary obligations or to implement even elementary corporate formalities required by law. Political activity and self-dealing are activities that most people involved in their own private foundation are usually keenly aware.

Fiduciary obligations are a bit more esoteric. A fiduciary duty is a legal duty to act solely in another party's interests. Parties owing this duty are called fiduciaries. The individuals to whom they owe a duty are called principals. Fiduciaries may not profit or otherwise benefit from their relationship with their principals unless they have the principals' express informed consent. They also have a duty to avoid any conflicts of interest between themselves and their principals or between their principals and the fiduciaries' other clients.

A fiduciary duty is the strictest duty of care recognized by the U.S. legal system. When you are in a position that entails a fiduciary duty, it is in your best interest to read all that you can to fully understand what such a duty entails.

The charge of failure to implement “even elementary corporate formalities required by law” is another area where the average family with a private foundation may lack a basic understanding. As interpreted by the New York AG, this is a significantly serious shortcoming. Yet many private foundations operate in the same informal manner as the Trump Foundation has. I will get into this more in future writings.

How serious are these issues? New York State wants Donald, Ivanka and Eric Trump to make restitution and pay penalties resulting from their breach of fiduciary duties. New York wants Donald Trump to pay up to double the amount of benefit he improperly obtained through related party transactions entered into after July 1, 2014. (I don’t know the significance of that date.) These are unusual penalties and more unusual in that they are directed personally against the volunteer board members of a charitable organization.

Of course, the Trumps dismiss this action as totally baseless. Regardless, I believe there are some learning opportunities for those involved in private foundations as well as not-for-profit charities in general, especially board members and high level management personnel. I will be exploring the legal filings in depth over the next few weeks and report what I find.