About that Visa: Why Global Grantmakers Need to Study up on Immigration Law

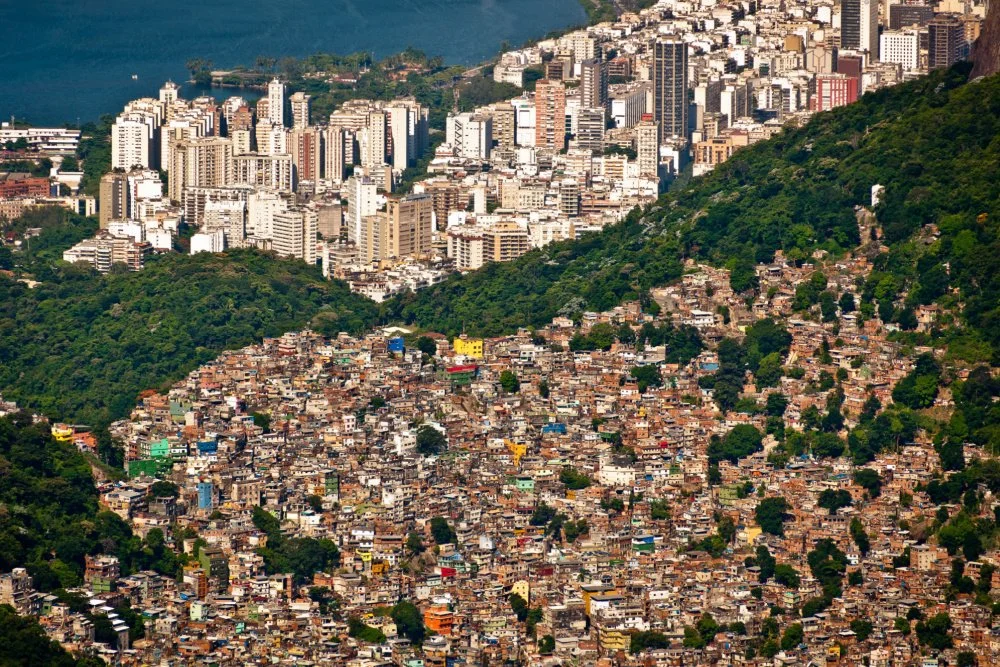

/Tang Yan Song/shutterstock

Cross-border giving accounts for a sizable slice of U.S. philanthropy, totaling $22.88 billion in 2018 according to the latest data from the Giving USA. American funders partner with, and invest in, myriad international projects and nonprofit organizations every year.

But according to Ted Hart, President and CEO of the Charities Aid Foundation of America, giving overseas can be tricky. Hart warns in his recently released workbook “Cross-Border Giving: A Legal And Practical Guide” that funders can be exposed to risks if they do not understand financial and accounting regulations when giving internationally.

One area that can trip up global funders is U.S. immigration law. Why do funders—and those they fund—need to pay attention?

How immigration law plays a role

International major giving does not happen in a vacuum. Most U.S. funders who are inspired to make a significant commitment to a foreign-based organization have developed close relationships with the NGO and its American 501(c)(3) counterpart. Thousands of organizations, including those that are commonly known as “American Friends” and referred to as “American arms” of NGOs abroad, create opportunities for U.S.-based funders to help solve urgent needs and to actualize their individual values and dreams in communities across the globe. It is these personal relationships between U.S. staff and NGO leaders abroad that assures funders of the ROI of their foreign philanthropic investment.

Visits to U.S. by foreign nonprofit professionals are both the norm in cross-border giving as well as considered best practice. These visits and face-to-face moments are instrumental for the success of global philanthropic partnerships.

In this pursuit, both funders and nonprofit professionals have to keep a close eye on complying with US immigration regulations. Immigration laws define and impact the visit of an individual, whether a professional and volunteer leader, who does not hold American citizenship or has no work authorization.

Where U.S. immigration law and fundraising clash

U.S. Immigration law is straightforward: neither visitors under the Visa Waiver Program nor B1-Visa holders are granted permission to perform work in the United States. The Foreign Affairs Manual which is the guidebook to consular officers further elaborates on the concept of “work” and refers explicitly to fundraising activities. It states that the activity in the United States “may not involve the selling of articles or the solicitation or acceptance of donations.” These legal stipulations set clear boundaries for foreign executives and fundraisers.

Even though the Foreign Affairs Manual leaves no doubt about the unlawful nature of soliciting and accepting donations, it is less illuminating about some of the common activities associated with fundraising, such as attending and speaking at fundraisers. It also does not even shed light on what it considers a “donation.”

These gray areas deserve attention as nonprofit organizations depend on the funders’ trust and continued partnership with the foreign NGO and its leadership. Moreover, individuals employed by non-U.S. based NGOs and volunteer leaders have to keep in mind that immigration is a personal matter. First and foremost, it will be the executive, fundraiser, and volunteer who will risk their visa status and jeopardize future visa eligibility if doubts about the nature of their visit arise—in the worst case scenario, with irreversible consequences.

Navigating Immigration law

What does all this mean for foreign nonprofit professionals and volunteers who come to the United States to build relationships, cultivate and steward donors, and represent their organization? David Grunblatt, Co-Head of the Immigration & Nationality Group in the Labor & Employment Law Department at Proskauer Rose LLP, points out that American-based funders serving on nonprofit boards need to be well informed and know immigration regulations.

First, non-US citizens living abroad and coming to the United States on behalf of a foreign NGO should focus on fostering partner relationships, promoting collaborations and raising awareness about the organization’s work. Second, they have to refrain from directly making any personal solicitation and cannot accept cash donations. Third, visiting nonprofit executive, fundraisers, and lay leaders cannot receive U.S. compensation for their time in the United States. Fourth, the reasons for regular short-term trips are easier to explain at customs or the consulate officer than reasons for extended annual trips. Fifth, it is critical to keep in mind that immigration laws do not permit anyone coming to the States on a Visa Waiver or B1-Visa to work in America.

While existing regulations can offer guidance, they will continue to raise many questions. Global giving in a global world requires an understanding of immigration legal frameworks and calls on professionals and funders to be responsible stewards of their relationships and the NGO they represent.