Think Big: Behind a Push to Unlock Billions in New “Catalytic” Capital for Global Development

/SDG #4 focuses on access to education for all children.

If timing is everything, the Catalytic Capital Consortium—an impact investing initiative launched in March by the MacArthur Foundation and two other sector leaders—comes at the right time for investors who believe that greater, more creative use of financial capital is essential to solving the world’s most pressing problems.

Impact investing has been part of MacArthur’s work for more than three decades, but the foundation has raised its ambitions on this front in recent years. In an earlier interview with IP, Managing Director Debra Schwartz hinted at incubating bold, new endeavors to mobilize unconventional capital.

The Catalytic Capital Consortium, or C3, reflects these aims. It’s an investment, learning and market development initiative that brings leading impact investors together to help the sector realize its full potential and achieve the U.N. Sustainable Development Goals (SDGs). MacArthur created and leads the initiative, committing up to $150 million in investments on a matching basis. Omidyar Network and the Rockefeller Foundation are lending their expertise to the investment selection process. All three partners are collectively funding $10 million in grants to spur learning about catalytic capital in the impact investing community.

What is Catalytic Capital?

The Global Impact Investing Network’s (GIIN) 2018 Impact Investor Survey shows a diverse and growing market. But the survey also finds a “particularly” wide gap in “appropriate capital across the risk/return spectrum.” Of the $288 billion in impact investment assets today, only 5 percent are allocated below market.

These numbers offer a sobering reality check amid high hopes about impact investing. As MacArthur Foundation President Julia Stasch has explained, “much of the attention on impact investing focuses on market-rate returns, leaving a serious gap in financing opportunities for many promising impact enterprises and funds that could help address critical social challenges.”

That gap underscores the potential for foundations to play a critical role in the impact investing space, even as some skeptics argue that these institutions shouldn’t put precious endowment wealth at risk.

On the investing spectrum, catalytic capital differs from conventional capital in its ability to carry greater risk, its lower rates of return, and its longer time horizons to achieve positive impact. It also enables third-party investments that wouldn’t otherwise be possible. MacArthur calls such capital “patient, risk-tolerant, concessionary and flexible.”

Catalytic capital isn’t appropriate for all investors, and isn’t an easy financing solution across the board. But MacArthur believes C3’s backing can play a “derisking” role that can bring like-minded investors off the sidelines for certain opportunities. It also expects its capital to help funds and social enterprises safeguard their missions, establish track records, and leverage additional investments to attract the financing they need, even from conventional investors.

Looking at the big picture, Debra Schwartz says C3’s strategy is to “inform, inspire and empower investors who want to make catalytic-capital investments that unlock, accelerate, and expand impact, working in concert with other forms of investment, including those with market rates of return.”

Huge Funding Shortfalls

So how is this strategy playing out so far? And what does the future hold?

MacArthur’s first move was to commit $30 million to expand and accelerate the Rockefeller Foundation’s Zero Gap initiative. Zero Gap leverages innovative finance mechanisms to close the gap between available resources and global development funding. The collaboration between the two foundations aims to catalyze equal investments of $30 million to at least $1 billion in new capital to meet the SDGs.

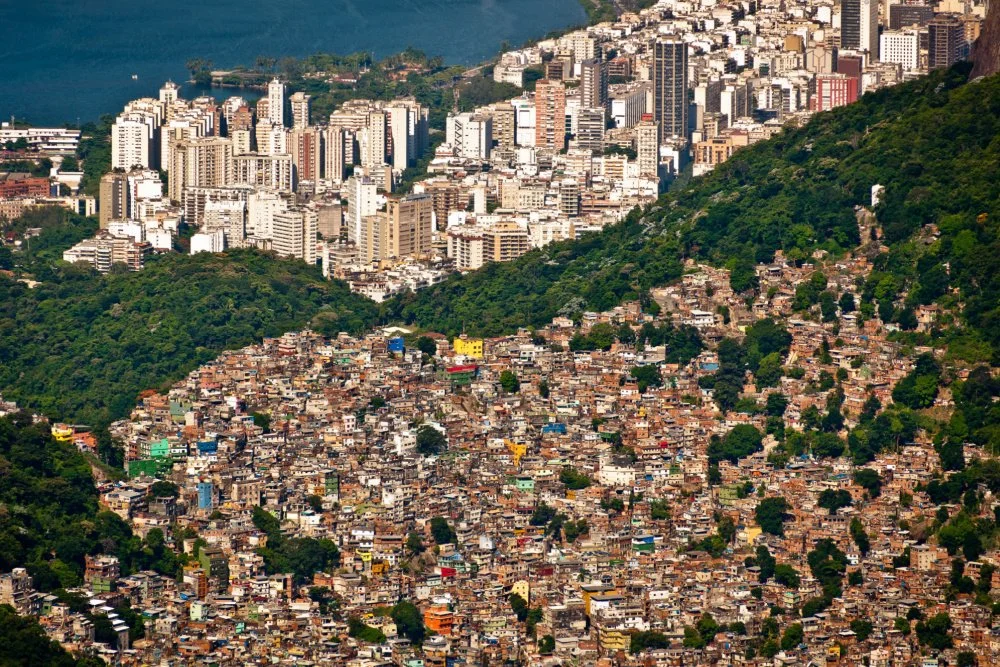

The urgency of attracting new capital to advance global development is clear. Rockefeller calls the current shortfall “astronomical,” and estimates an annual SDG funding gap of $2.5 trillion for developing countries alone. The United Nations Conference on Trade and Development puts the overall annual shortfall at between $5 trillion and $7 trillion. Unlocking some of the more than $200 trillion in private capital that’s currently invested in global financial markets—and deploying those funds effectively—is essential to bridging the gap.

The U.N.’s 17 Sustainable Development Goals (SDGs) are ambitious, providing a shared blueprint to end poverty, protect the planet and ensure that all people enjoy peace and prosperity. The timeframe is equally ambitious, setting specific targets to address far-reaching issues from gender equality to affordable clean energy by 2030.

Regarding the focus on meeting SDGs, Schwartz says that these goals “represent an important way to align impact investing globally, focusing on high-priority challenges around the world.” She also says that more than 100 “impressive” requests to support catalytic capital field partnerships have already come across the transom through the invitational proposal process. Decisions will be announced in the coming months as new investments are approved and closed.

Guidelines for grants to fuel learning and market development are expected in September. Grantmaking is expected to begin in the fall, and continue for three years.

Meanwhile, the consortium invites the community of investors, entrepreneurs and researchers who share their views on the power of catalytic capital to learn more at www.macfound.org/CatalyticCapital.

Related: