Philanthropy’s $9 Trillion Blind Spot

/Paul Brady Photography/shutterstock

This article was originally published on June 7, 2023.

The most recent debt ceiling debacle is the latest chapter in the nation’s decades-long political contest over federal spending and taxation. In the view of many conservatives, the ballooning federal debt is a crisis of runaway government spending. But the federal debt is more properly viewed as a crisis of taxation. The debt represents the failure of government to raise the revenue it needs, especially from the wealthiest Americans, to advance our most vital national priorities: a vibrant and inclusive economy, a safe and clean environment, and the equality that is foundational to a functional, multiracial democracy.

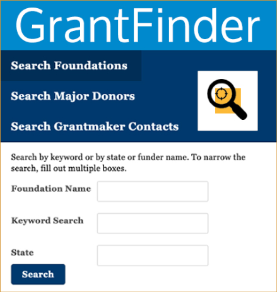

This debate strikes at the very heart of the type of society our nation aims to build and of the nature of our social contract. And yet, remarkably, it is a debate in which progressive foundations have largely remained on the sidelines. Until recently, few funders have made investments in policy advocacy or organizing for a more progressive tax system. Based on foundation data at Candid, grantmaking in the area of public finance totaled just $67 million in 2021, which is less than it was a decade ago, and far less than what’s going to longstanding philanthropic priorities such as education, health and the arts, which receive billions.

According to Frank Clemente, cofounder and first executive director of Americans for Tax Fairness, a coalition of 420 organizations that advocates for progressive tax reform, “The amount of money on our side is infinitesimal compared to the other side, which includes all of corporate America.”

Funders should do more. Government has a vital role to play in addressing virtually every issue of importance to philanthropists — education, healthcare, the environment, poverty and more — and its capacity for investment dwarfs that of private philanthropy. Total government expenditures in the U.S., including state, local and federal spending, now exceed $9 trillion annually, far surpassing the social sector’s $485 billion in annual charitable giving. In the last three years, since the onset of the pandemic in 2020, the federal government has authorized more than $6 trillion in new investments, including pandemic relief spending, the bipartisan infrastructure bill and the Inflation Reduction Act (IRA). These investments are having a transformative impact on American society, on issues like poverty reduction, public health, infrastructure, energy and the environment, industrial policy, and much more. Philanthropy simply cannot match the scale of government investment and must use its voice and influence to ensure the public coffers are full.

A progressive tax system is also one of our most powerful tools for reducing economic inequality and the racial wealth gap. Income and wealth inequality declined in the 20th century when the progressivity of the tax code was at its apex in the U.S. and Europe. Progressive taxation did not impede economic growth, and, in fact, correlated with higher GDP growth in the 20th century.

A more progressive tax code reduces economic inequality in several ways. Taxes on the wealthy are redistributed to lower and middle-income Americans through public investment in education, healthcare and other social welfare benefits, or through tax credits like the earned income and child tax credits. A progressive tax code also influences how companies and industries structure their workforces. Consider that as income tax rates for top earners have fallen over the last 60 years, CEO pay has surged while average workers’ wages have stagnated. CEOs earned 351 times more than front-line workers in 2021, compared to 21 times as much in 1965. A more progressive tax code with higher marginal income tax rates for top earners and more equitable tax treatment for capital gains would make it more costly for companies to provide outsized compensation for C-suite and other executives, while encouraging them to create middle-income jobs that can sustain and grow the American middle class.

Reforming the tax code is also an important tool for addressing the racial wealth gap. The tax code is packed with features that tend to disadvantage Black Americans and other racial minorities. For example, lower taxes on income from capital relative to income on labor favors whites, who on average hold more capital assets than Black Americans due to the legacies of slavery, Jim Crow and other racist policies and systems. Similarly, the mortgage interest tax deduction favors whites, who have higher rates of homeownership than Blacks due to decades of racist housing policies.

While philanthropic investment in progressive tax reform has been lacking historically, an emerging network of funders and advocacy groups is building new capacity and infrastructure to advance progressive tax policies. The State Revenue Alliance provides funding, communications support and other technical assistance to grassroots organizations, unions and advocacy groups working for more equitable tax policies at the state level — such as the recently enacted millionaires’ tax in Massachusetts. The State Revenue Alliance and the State Innovation Exchange recently helped launch an initiative to pass new wealth and capital gains taxes in eight states. And a group of foundations, unions and high-net-worth individual donors has been convening with leaders in the field during the last several months to build a shared vision, strategy and campaign infrastructure for advancing a more equitable, pro-worker tax system.

According to one of the leaders of this new effort, Danielle Goonan of the Rockefeller Foundation, “The tax system is critical for building an inclusive economy. From stimulus checks and other forms of unconditional cash, to the transition to a green future [via the Inflation Reduction Act], to healthcare and coverage for millions of Americans, the tax system has become a benefits system that can either improve or hinder worker stability. So many of the policies that we need to build a just and inclusive economy require tax revenue. That is why it is critical that funders from across issue areas invest in the baseline capacity of the tax field and education on the benefits themselves.”

An equitable and progressive tax system is essential to our democracy and to our ability to achieve the public good. In the words of Oliver Wendell Holmes, Jr., “Taxes are the price we pay for civilized society.” Philanthropists should step off the sidelines and invest more in this important but neglected domain.

Loren McArthur is an independent consultant and philanthropic advisor.